05 Fév Variance Analysis

During the year costs are allocated to inventory and cost of goods sold based on the actual volume of production at the standard rate. In conclusion, the variable overhead variance is an important tool for measuring and controlling indirect costs, and is used to evaluate the efficiency of overhead spending. Consequently by analyzing the variance, management can identify areas for improvement and take steps to reduce the cost of variable overhead, thereby increasing profitability and competitiveness. Such variance amounts are generally reported as decreases (unfavorable) or increases (favorable) in income, with the standard cost going to the Work in Process Inventory account.

Direct Materials

Contrast this to standards for cost variances, which as I say below are always per unit numbers. Standard quantity is the quantity of an input (direct labor, direct how to make a billing invoice materials, or overhead) per unit produced. Just because that’s the standard quantity doesn’t mean you can plug that number in for actual or budgeted quantity.

Recording Cost of Goods Sold Transactions

Management use standard costing and variance analysis as a measurement tool to see whether the business is performing better or worse than the original budget (standards). Which variances are calculated and shown in the variance report depends on how useful the information will be in controlling the business. If the quantity of direct materials actually used is less than the standard quantity for the products produced, the company will have a favorable usage variance. The amount of a favorable and unfavorable variance is recorded in a general ledger account Direct Materials Usage Variance. (Alternative account titles include Direct Materials Quantity Variance or Direct Materials Efficiency Variance.) We will demonstrate this variance with the following information.

Using Standard Costing and Variance Analysis

A static budget (column F) and a flexible budget (column G) are both shown below. For the flexible budget, I used the same assumptions as the static budget but changed the volume to 110 units (compare cells F3 and G3). Variance analysis moves incrementally from one extreme to the other, comparing just one standard-versus-actual result at a time. This leads to variances that tell you how much of total budget variance is due to each cause.

( Reasons of variances:

That component of a product that has not yet been placed into the product or into work-in-process inventory. This account often contains the standard cost of the direct materials on hand. A manufacturer must disclose in its financial statements the actual cost of materials on hand as well as its actual cost of work-in-process and finished goods. That part of a manufacturer’s inventory that is in the production process and has not yet been completed and transferred to the finished goods inventory. This account contains the cost of the direct material, direct labor, and factory overhead placed into the products on the factory floor. A manufacturer must disclose in its financial statements the cost of its work-in-process as well as the cost of finished goods and materials on hand.

- After the March 1 transaction is posted, the Direct Materials Price Variance account shows a debit balance of $50 (the $100 credit on January 8 combined with the $150 debit on March 1).

- He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

- The production that is acceptable (not rejected products) and which is assigned manufacturing costs of direct materials, direct labor, and manufacturing overhead.

- The inventory system where purchases are debited to the inventory account and the inventory account is credited at the time of each sale for the cost of the goods sold.

- The variable components may consist of items like indirect material, indirect labor, and factory supplies.

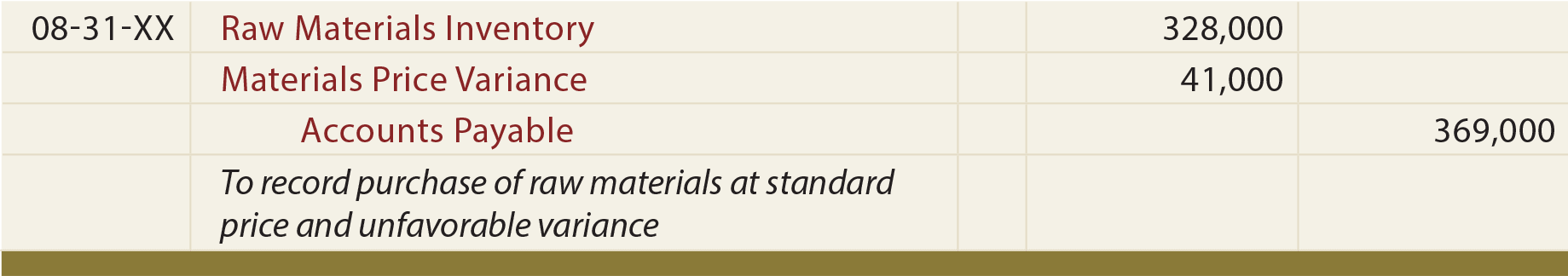

This chapter has focused on performing variance analysis to evaluate and control operations. Standard costing systems assist in this process and often involve recording transactions using standard cost information. When accountants use a standard costing system to record transactions, companies are able to quickly identify variances. In addition, inventory and related cost of goods sold are valued using standard cost information, which simplifies the bookkeeping process. This reflects the standard cost allocation of fixed overhead (i.e., 10,200 hours should be used to produce 3,400 units).

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. During the month, Exide purchased 21,120 kilograms of materials from vendors. There was no inventory of materials in stock at the start and at the end of the month. For the remainder of our explanation, we will use a common format for calculating variances. The amounts for each column are computed in the order indicated in the headings.

The standard cost budget variance applies only to fixed costs and is the difference between the budgeted fixed overhead and the actual fixed overhead. The standard costing variance is negative (unfavorable), as the actual units used are higher than the standard units, and the business incurred a greater cost than it expected to. Variance analysis is the process of breaking down the difference between standard (budget) and actual costs to explain whether differences in price, quantity or both caused the business not to perform to expectations. A term used with standard costs to report a difference between actual costs and standard costs.

Now let’s assume that the actual cost for the variable manufacturing overhead (electricity and manufacturing supplies) during January was $90. Keep in mind that the standard cost is the cost allowed on the good output. Putting material, labor, and manufacturing overhead costs into products that will not end up as good output will likely result in unfavorable variances. The firm can record the price variance as part of its entry recording purchase of new direct materials. The credit will be the actual cost, usually credited to either cash or accounts payable. If you can remember that actual quantity will be different for quantity and price variances, you can calculate direct materials variances in a way that is very similar to direct labor variances.

No Comments