26 Sep Most buyers trying to find delivering a mortgage whenever notice-functioning do greatest with the exact same types of funds as the almost every other borrowers

Delivering acknowledged having a home-operating home loan

If you are not sure getting accepted having a mortgage when self-operating, try such four trick actions to maximise the probability.

- Implement that have aco-borrowerwho has antique earnings. Mortgage loans to possess notice-working borrowers are easier to score that have a co-borrower. Loan providers tend to be more likely to accept your in the event that discover two different people towards the hook up to your obligations, one of who brings in money from a timeless resource.

- Improve your down payment. One huge reasoning it’s more difficult to find mortgages to have self-functioning borrowers? Loan providers view you as the an excellent riskier bet. Whatsoever, as you don’t possess a pals which is promised you an income, there’s an elevated chance your income sources is going loans in Jansen to run deceased.When you can reduce the level of exposure you establish, loan providers may give you a home-employed mortgage. And also make a more impressive downpayment reduces the risk in 2 ways: Basic, you are borrowing less, so that the lender is not putting normally money on the line. And you will 2nd, you have more substantial share regarding bargain. If the loan providers need certainly to foreclose, there’s never as options they had lose cash (because your bigger deposit offered you more equity).It can be hard to rescue to have a down payment, however, of the overseeing your financial budget cautiously and investing in a lot more era, it can be done. Fool around with our home loan calculator observe exactly how your own monthly payment will change that have a bigger deposit.

- Make sure that your monetary history is impressive. It is not merely a high advance payment one decreases the chance your present to lenders — you can also look like a safer wager when you yourself have a strong credit history and plenty of income. If the personal debt-to-earnings ratio is lower, may possibly not count as often if the lenders never number all of the yourself-a job income when deciding whether to accept your loan. And if you really have a good credit score, you will have a greater choice of mortgage loan organization willing to approve you. Improving a credit score should be difficulty, but paying personal debt and making certain there aren’t any mistakes on the credit file can raise your credit rating quickly.

- Be mindful regarding the and therefore income tax deductions you claim. An universal problem for individuals who are thinking about mortgages for self-operating borrowers is that businesspeople commonly clean out their fees by the stating every it is possible to deduction. You to lowers the fresh taxable money one lenders thought when deciding in the event that you could borrow and just how high home financing you qualify for.Once you know we wish to pick a property in the near future, you might be a bit more judicious to the write-offs your allege. That will imply you only pay a high goverment tax bill otherwise write off as numerous team costs, nonetheless it can make a huge difference obtaining accepted to own a mortgage. You may day highest taxation-deductible providers expenses and that means you never happen them eventually prior to trying in order to borrow.

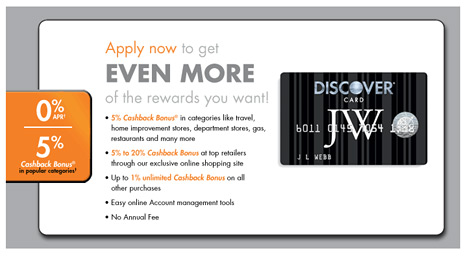

Self-operating and require a credit card? Have a look at Ascent’s self-help guide to an informed playing cards having self-working somebody and select the fresh cards which is good for you.

Particular mind-functioning mortgages

This could mean conventional mortgage loans maybe not supported by government lenders. Or you might think FHA, Va, otherwise USDA money if you would like an authorities-covered mortgage. You can discover a little more about mortgage systems within beginner’s publication to help you mortgage brokers and more regarding the best FHA lenders when you may be happy to start off.

There are categories of mortgage loans that require little or no paperwork — in the event these are generally much harder to find today, due to the subprime home loan crisis. They’re:

No Comments